Since I had already opened my first online investment account, I decided to use it to grow my savings at a faster rate than inflation and hopefully buy a car and pay off my outstanding credit card balance. The very first shares I bought was Helmerich & Payne, Inc (NYSE:HP). I got lucky with this stock as I could only afford to buy 2 shares at US$77.00 each and was able to sell them at US$114.00 each in April 2014. I was hooked. Over the next three years, I opened another online trading account and lost approximately 64% of the money I invested. Keep in mind I had invested less than $6,000.00 up to this point so the amount actually lost is really small. I consider this the cost of learning how not to loose money on the stock market.

In my quest to grow my investments to achieve my goals I searched YouTube for investing courses. Courses approved by Warren Buffett were easily found and seemed to be sound advice. However the information was virtually impossible to follow. What I did not know at the times was that I was entering the market at very close to the top. This made it very difficult to find undervalued stocks that matched Warren's stated investment criteria of low book value, low price to earnings, high earnings per share and a long history of steadily increasing dividends payment.

At my new bank (Royal Bank of Canada), I discovered they have an investment game called Practice Account which starts with $100,000.00 of play money. My first game was started in February 2014 and by July it had reached $550,000,000.00. The majority of the increase was due to luck of starting the game six months before the market reached it's first top due to US Feds stimulus. Since then this game has dropped down to a low of $250,000,000.00 and gone up to $400,000,000.00. I started four other games to test different investment strategies as well as trying to replicated the same performance with the same strategy. These games were started in June, July, August and September of that year. All the games lost money and never recovered back to the original $100,000.00 starting point.

Through out 2014 and 2015, the losses mounted. But the Toronto and New York indexes continued to rise. So I must be missing something. In late 2015 I started looking for advise on YouTube and found a number of great alternate sources that gave me a sense of why the market was performing the way it was. Then at the beginning of 2016, I started noticing a trend in my investments - most of my stocks had very high debt to equity rates and these stocks had the greatest losses. The stocks with no debt or the least debt to equity ratio had the greatest gains or the lowest losses. The other thing I notices was the stocks with the greatest yield were the ones to drop in value the fastest. By this time I had discovered Google finance (Canada) was the easiest financial information service to use and understand.

In late 2015, I also discovered Google finance also allows users to create their own portfolios or, as I call them, games. These games allows a lot more flexibility that RBC's Practice Accounts. I created seven games, two of which are to track my real accounts and the other five are to test different strategies. Two of these games are for testing foreign markets, specifically Australia and Russia. It soon became apparent that Google finance is the best place for me to do research into which stocks to invest in. Strangely enough, all the games on Google, with the exception of the two that tracks my real trading accounts, were making money. This is mostly due to me being able to edit my trades to take advantage hind sight. However, I noticed that almost all my stocks in both accounts had debts that were equal to or greater that the shareholders equity. They all had to go even though they were paying a dividend. But what to replace them with?

As the summer of 2015 was drawing to an end, I noticed two Canadian oil sector companies that looked promising - Granite Oil Corp (TSE GXO) and High Arctic Energy (TSE:HWO). I tracked them in one of my games and decided to buy Granite Oil in February 2015 at $7.57 per share. What I did not know was it was at the top of it's cycle. It really did not matter as only 20 shares were bought. Since then I have accumulated 140 shares which pays a total of $4.90 (or $0.035) per month in dividends. If I had bought High Arctic at that time instead I would have more than doubled my money as well as received monthly dividends of $0.025 per share. It became obvious I was still missing something.

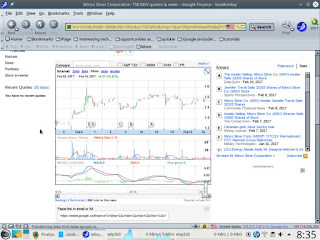

As luck will have it, in the fall of 2015, the alternate financial advisers I follow were strongly advising to buy silver. Then in January, a number of them started advising to buy silver and gold junior miners. I started tracking a number of the stocks they recommended and actually bought a few. They were a mixed bag of results. One in particular is Minco Silver Corporation (TSE:MSV). If it was bought in February 2016 at $0.485 per share, I would have almost tripled my money. The image above shows the recent price and technical data of Minco Silver. The bottom graph containing the red and blue lines is the "Moving Average Convergence Divergence" or MACD. This is the latest piece in the puzzle that I have learned.

As luck will have it, in the fall of 2015, the alternate financial advisers I follow were strongly advising to buy silver. Then in January, a number of them started advising to buy silver and gold junior miners. I started tracking a number of the stocks they recommended and actually bought a few. They were a mixed bag of results. One in particular is Minco Silver Corporation (TSE:MSV). If it was bought in February 2016 at $0.485 per share, I would have almost tripled my money. The image above shows the recent price and technical data of Minco Silver. The bottom graph containing the red and blue lines is the "Moving Average Convergence Divergence" or MACD. This is the latest piece in the puzzle that I have learned.It does not matter whether the company is profitable, undervalued or even grossly overvalued. If the MACD has a negative divergence greater than -1 (red line is above the blue line), it may be a good time to buy. If it has a positive divergence greater than +3 (blue line is above red line), it is definitely time to sell. Since I learned this I have been able to identify when to take profits before the stock returns to the bottom of it's cycle.

Since my preference is buying stocks that pays dividends, I have three stocks to accumulate. Two were mentioned above and are in the oil sector. The third is Sentry Select Primary (TSE:PME). They have very low price to earnings, low price to book and no or low debt to shareholder equity as well as pay monthly dividends. I recommend a strategy of accumulating these stocks (GXO, HWO and PME) while their MACD is negative and selling half of them when their MACD reaches a positive 3 or higher. Then start accumulating again when their MACD is negative. again. This way you will always have monthly income from your investments and take some of your gains off the table to reinvest later in the same stocks, invest in other opportunities or simply to reward yourself.

Other junior mining stocks to consider are First Mining Finance (CVE:FF), Balmoral Resources Ltd (TSE:BAR), Eastmain Resources Inc (TSE:ER) and Callinex Mines Inc (CVE:CNX). As above, I suggest buying while their MACD is negative and selling while their MACD is positive.

N.B. I am not a licensed financial adviser nor should you take this information as sound financial advice. This post is provided to enlighten DIY investors on how to reduce their losses and hopefully increase their gains from what I have learned by loosing over $3,500.00 in the past 42 months. The stocks listed above I actually own and plan to continue trading according to their MACD.

Your comments are welcome. If you found this post helpful, please share on your social networks.

No comments:

Post a Comment